wyoming property tax rate

The average property tax rate is only 057 making Wyoming the lowest property tax taker. Property Tax Payment and Inquiry.

Are There Any States With No Property Tax In 2022 Free Investor Guide

Weston County collects on average 05 of a propertys.

. You can look up your recent. Property Tax Exemptions Relief or Refund Programs. Wyoming ranks in 10th position in the USA for taking the lowest property tax.

Median Income In Wyoming. 2021 Median Household Income. 2021 Median Property Tax Calculations.

That is a tax imposed according to the value of the property. 2021 Property Tax Refund Program Brochure. Every district then is given the assessed amount it levied.

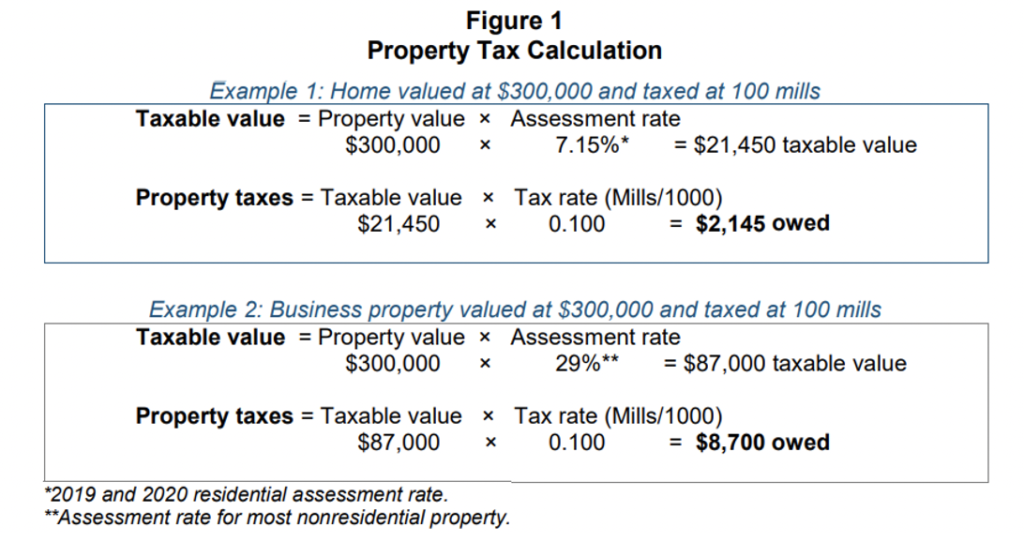

Tax amount varies by county. Along with collections property taxation includes two more overarching steps which are formulating real estate tax rates and. Assuming your home has an appraised value of 100000 the assessed value would be.

Property Tax Sale The next Tax Sale is scheduled for. The Assessment Rate is 95 for agricultural commercial and residential property 115 for industrial and 100 for minerals. A property tax is an ad valorem tax.

Which is a tax imposed according to the value of the property. The median property tax in Wyoming is based on a median home value of and a median effective property tax rate of 058. The market value multiplied by the.

Property Tax Sale The next Tax Sale is scheduled for. The mission of the Property Tax Division is to support train and guide local governmental agencies in the uniform assessment valuation and taxation of locally assessed property. In Wyoming the County Assessor is charged with the responsibility to value property.

The states average effective property tax rate is just 057. Property Tax Payment and Inquiry. The median property tax in Wyoming is 105800 per year for a home worth the median value of 18400000.

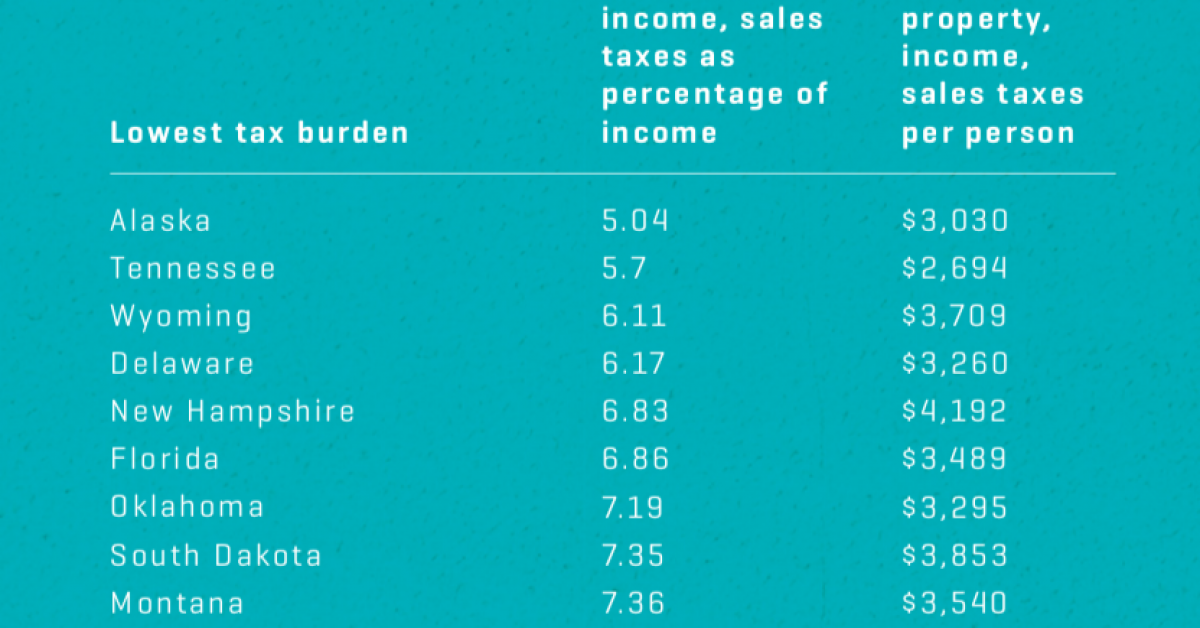

You can click on the plus sign next to the taxes for more detailed information. The median property tax in Weston County Wyoming is 579 per year for a home worth the median value of 115200. Wyoming Property Taxes Despite the fact that there is no state income tax in Wyoming it has among the lowest property taxes in the US.

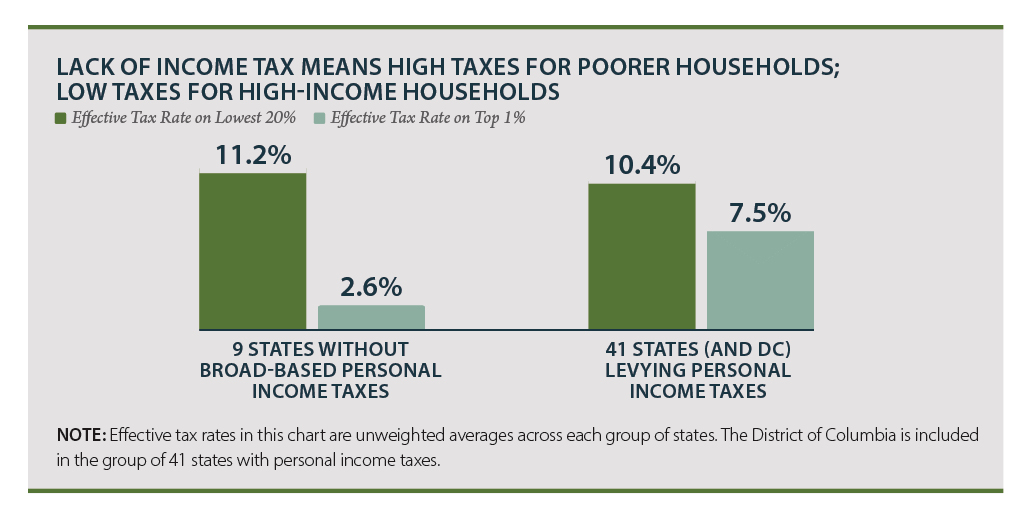

Despite the fact that there is no state income tax in Wyoming it has among the lowest property taxes in the US. Recent delivery of tax bills to taxpayers only increases the drum beat. The state of Wyoming requires that residential properties be assessed at 95 of their appraised value.

Back to Administrative Services Division. The states average effective. 1 be equal and uniform 2 be based on current market value 3 have one estimated value and 4 be held taxable unless specially exempted.

Business Personal Property Taxes Property Assessing Reform City Clerk Boards Commissions Committees. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200 percent and an average combined state and local sales tax rate of 522 percent. Once the county assessor has determined fair market.

Wyomings tax system ranks. Defining Evaluating Property Taxes A property tax is an ad valorem tax. Candidates in the 2022 primary election heard from voters that rising property taxes are front of mind.

The residence and any additional structures. Taxation of real property must. Property Tax Exemptions Relief or Refund Programs.

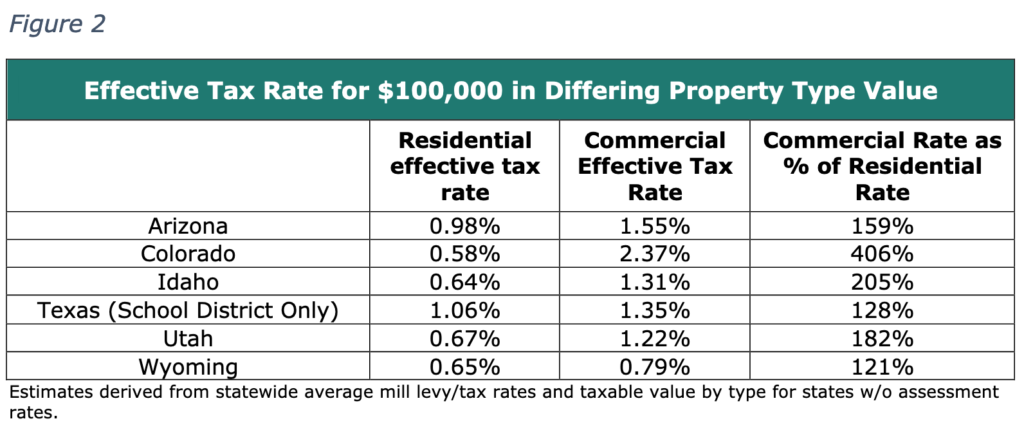

Wyomings property tax rate is 115 for industrial property and 95 for commercial residential and all other property. Counties in Wyoming collect an average of.

Are There Any States With No Property Tax In 2022 Free Investor Guide

State Income Tax Rates And Brackets 2021 Tax Foundation

States With The Highest And Lowest Property Taxes Home Sweet Homes

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Tax Rates To Celebrate Gulfshore Business

Tax Benefits Of Living In Wyoming Wyoming Real Estate Blog

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Wyoming Sales Tax Calculator And Local Rates 2021 Wise

2022 Property Taxes By State Report Propertyshark

Wyoming Alaska And S Dakota Top Tax Friendly Business State List

Wyoming Wy State Income Tax Information

Where Are Real Estate Taxes Lowest And Highest The New York Times

Wyoming Tax Rates Rankings Wyoming State Taxes Tax Foundation

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

How Taxes On Property Owned In Another State Work For 2022

Wyo Property Tax Rates Rank Right At The Bottom Wyoming News Trib Com